Most taxpayers in Germany have the right to submit income tax return forms (Einkommensteuererklärung), whether they are actual German citizens or expats. When doing this for the first time, it is normal to be uncertain about the process and having lots of doubts and questions.

Bureaucracy can be a major headache and that’s why this article is dedicated to the tax return in Germany, from completion to submission.

What Is a Tax Return?

In short, a tax return is a form that you fill out and send to the government to report your income, expenses and the taxes you’ve paid. It helps the tax office determine whether you owe the state money or get a refund.

In Germany, filing a tax return works the same. You file the document and check whether you have paid the correct amount of tax for the previous financial year. You’ll be glad to know that most of the time, you end up paying more taxes, which makes you eligible for a refund. On that note, statistical data suggests that around 88% percent (more precisely, 12.7 million out of 14.4 million) have received tax refunds in Germany in 2019. On average, the refunded amount was €1,095.

Typically, you fill out these forms either manually or online, for the Federal Central Tax Office (Bundeszentralamt für Steuern or BZSt). As mentioned, the purpose of the return is to help the tax office balance out the amount of income tax you’ve paid throughout the year with other financial aspects. These include:

- Additional income sources

- Your partners income

- Tax deductions, insurance contributions, charitable donations and other expenses.

Who Needs To File A German Tax Return?

Even though lots of people who earn wages in the country submit tax returns hoping for refunds, for the most part, waged employees paying payroll taxes aren’t obligated by law to submit German income tax returns. However, the following categories are obligated to submit these declarations:

- Self-employed tax payers (business owners or freelancers)

- Citizens who receive income from abroad

- Citizens with multiple income sources

- Married people who are in tax classes three or five

- Citizens who received exceptional amounts of income, such as severance payments

- Divercoed citizens whose ex-partners have remained the same year.

- Citizens who wish to apply for tax deductions

- People who have received over 410 euros in welfare benefits, such as unemployment, maternity leave, sick leave, and child benefits

- When the tax office asks you to file a return

Necessary Steps to File a German Tax Return

When you have a straightforward financial situation, meaning that you are a waged employee with only a handful deductions to declare (statutory insurance contributions and work-related expenses), filing a tax return in Germany is fairly easy. Still, you will need to understand the basics of German (or ask a friend to help or turn to professional tax assistance) and have all the necessary information and supporting documentation by your side.

For the sake of simplicity, you can also use online tools to fill out the form quickly. However, we advise using the help of a tax excerpt if you are facing a more intricate case, meaning that you have multiple sources of income or inheritance, or managing your own health insurance.

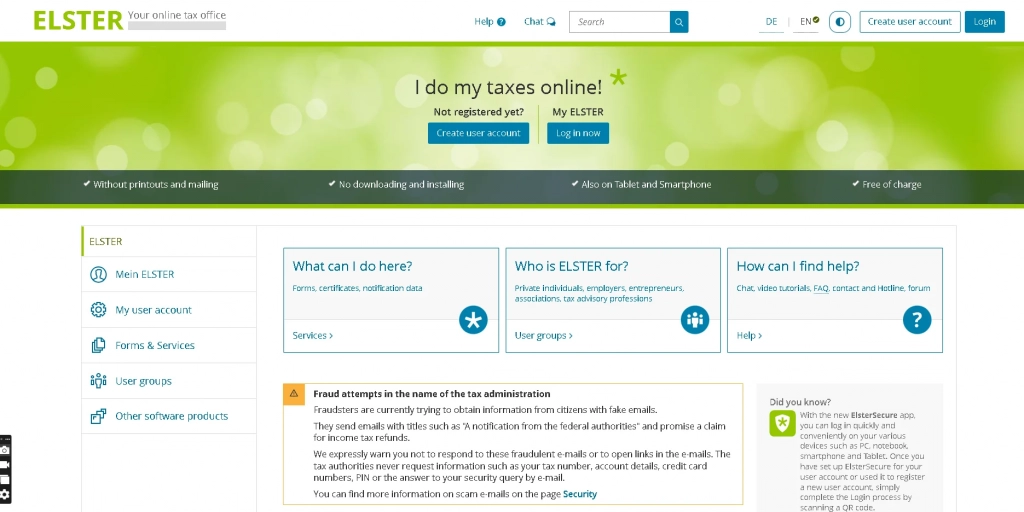

Online Tax Return in Germany: Using ELSTER

Even though you can download every necessary document, feel them out manually and send them to the Finanzamt (local tax office).However, using ELSTER (the dedicated ePortal) makes things much simpler.

Source: Elster.de

The portal’s interface is rather thorough and intuitive. It’s also available in English, so you can navigate through every bureaucratic step with more confidence and ease.

How to Apply for Tax Return in Germany: Necessary Information

To make the best of the tax return process, it’s best to have the essentials ready in advance. For the most part, you will only need the following to fill out the forms:

- A valid tax identification number (if you have it)

- The local tax office’s details

- Your German bank account’s IBAN

- Your Lohnsteuerbescheinigung, or employment tax statement which usually gets issued automatically at the end of the financial year by your employer.

- Proof of payments like receipts for your tax reductions (if applicable)

The Forms You Need

Regardless of financial situation, everyone who files tax returns in Germany will have to fill out the Mantelbogen or Hauptvordruck (the general tax form). Depending on your income type, you might also need to fill out additional tax forms, or Antagen.

General Tax Forms

In Germany, there are three different general tax forms and the one you will submit depends on your specific financial situation.

If you receive your income from a German employer, receive welfare benefit payments, and a stature pension, then the Vereinfachte Einkoimmensteuererklärung für Arbeitnehmer – Mantelbogen ESt 1V, or simplified tax form is the one you should fill out.

The Einkommensteuererklärung für unbeschränkt steuerpflichtige Personen – Mantelbogen ESt 1A is another form for tax return for individuals with unlimited tax liability. You should fill out and submit this form if you have additional income sources, or receive gains above 801 euros (1.602 if you are married), paying alimony, or which to declare additional deductions that the simplified tax return does not cover.

Lastly, the form with limited tax liability or Einkommensteuererklärung für beschränkt steuerpflichtige Personen – Mantelbogen Est 1C should be filled if you spend 185 days out of 365 days beyond German borders.

Anlagen or Additional Tax Forms

There are several of these and you will need to fill out a separate form for each of the expenditures and incomes that apply to you.

| Form Name | To Declare |

| AUS | Foreign income for self-employed |

| N-AUS | Foreign income for employees |

| Unterhalt | Payments to dependent persons |

| AV | Contributions to a Riester pension |

| Kind | Dependent children (for claiming child allowances) |

| G | Income from business enterprises |

| L | Agricultural or forestry income |

| SO | “Other,” such as property sale, damages, alimony, child maintenance or similar income sources |

| S | The income your receive from self-employed work |

| U | Alimony payments |

| KAP | Income from capital |

| R | Additional income, gross annual retirement benefits |

| V | Leasing or renting income |

| Vorsorgeaufwand | Pension, health, care insurance, and unemployment payments |

| N | Income from paid employment; gross annual salary; work-related tax deductions (i.e. expenses or commuting costs) |

Tax Classes

Lastly, to file tax returns in Germany, you will also have to know which tax category you are in. The Steuerklasse is assigned to you by the Finanzamt when you first register in the country, and it’s overly determined by your marital status. Your tax class will be highlighted on several documents, such as the employment tax statement or pay slip you receive from your employers.

Source: Pexels

Tax Deductions

Deductions allow you to reduce your tax liability and increase the chances of getting a refund. You can claim several payment types can be tax-exempt, if you declare them in your tax return.

- Employment Expenses: Workers in Germany are entitled to an €1230 allowance in business deductions. If you prove that your expenses exceed this sum, in several cases, you can deduct it if they haven’t been reimbursed by the employer.

- Insurance Contribution Deductions: You can also deduct the compulsory insurance contributions to specific limits.

- Personal Deductions: These are deductions from the costs like alimony payments, charitable contributions, church tax, and mortgage interest.

- Child Allowances: People with children are entitled to benefits and deductions, such as refunds from tuition fees and daycare costs.

While these are all deductible, you should be aware that each category has strict rules and limits. If you aren’t sure whether you are entitled to a refund, don’t hesitate to reach out to a tax advisor to reduce your tax bill.

Financial Year and Tax Return Deadlines In Germany

The financial year starts on the 1st of January in Germany and runs until the last day of December. Business owners and other professionals may be able to opt for different dates to coincide with their business needs.

For those who are obligated to submit returns, the submission deadline is very broad, spanning from the first of January to the 31st of July in the following financial year (31st of July 2026 for the 2025 financial year). There are also extensions and in some cases, your submission deadline may be moved to the end of the following February.

After submitting your return, you should receive the Steuerbescheid, or tax assessment from the Finanzamt between two to six months. The document will let you know whether you can get a refund or if you actually owe tax. If the latter is the case, you will have around four weeks to pay.

Finishing Thoughts Regarding The German Tax Return

Most blue-collar workers who are waged-employees don’t really have to worry about submitting tax returns. However, this doesn’t mean that you shouldn’t be familiar with the basics of the process.

Starting a new life abroad can present many opportunities and one of them is the ability to become self-employed or run your own business. In these cases filing your own tax return is essential. While this may be a long shot, it’s a possible reality, if you start your job search today. Browse our available vacancies and get closer to realising your dreams.

English

English  Lietuvių

Lietuvių  Latviešu

Latviešu  Polski

Polski  Português

Português  Română

Română  Slovenčina

Slovenčina  Magyar

Magyar  Русский

Русский  Espanol

Espanol  България

България  Čeština

Čeština  Italy

Italy  Croatia

Croatia  Greek

Greek