No matter how long you have worked in your profession, starting a career abroad has its own hardships. Sometimes, it’s not about the new workplace, coworkers, or even the language. Bureaucracy can also cause headaches, and people who tried understanding the German payslip for the first time probably know what we are talking about.

How do you decipher these cryptic calculations? Knowing what factors determine your salary, understanding allowances, deductions and income taxes is vital to have a comprehensive view of your salary.

German Payslip Explained

Similarly to its Dutch counterpart, the German payslip, or “Lohnabrechnung” is a full payroll statement that reveals how your employers pay you and it consists of all the essential details about your taxes, deductions, health insurance, pension, and social contributions. It aims to bring more clarity into the way you oversee your finances through every payment you get from work.

By understanding these German payslip printouts, you can be more effective with planning your budget, forecast your net salary and help you integrate into the German payroll system.

How To Read The German Payslip

To fully understand the German payslip, it’s easier to break down the document into three distinct sections: top, middle, and bottom.

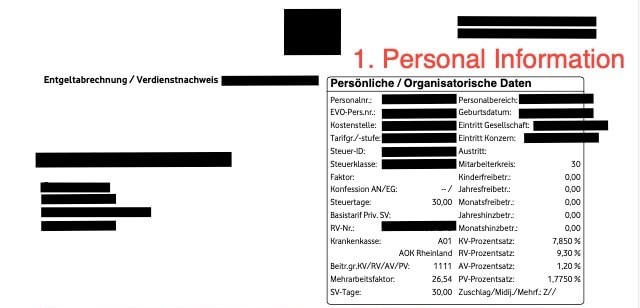

The Top of the Payslip: Essential Personal Details

The top of the document is pretty straightforward: you have your own personal information, the tax bracket they fall into, insurance classification, and even religion (to see whether you’re subject to church tax).

Here are three pivotal terms you should be focusing when reading your payslip for the first time:

- Steuerklasse (Tax Bracket): The tax factor or bracket is a classification mostly depending on your marital status (we’ve covered them already here).

- Personal Information: Important data about you, such as birth date, name, address, and so on.

- HR Group: Information about your insurance classification.

To break it down even more precisely, here’s the actual information on the list, in German:

- Personal-Nr or Arbeitnehmer Nr. Personal-Nr: The employee’s number

- Geburtsdatum: Your date of birth

- StKl. (Steuerklasse): Tax classification

- ZKF (Zahl der Kinderfreibeträge) oder Ki.Frbtr. (Kinderfreibeträge): The number of tax exemptions for kids (one for each child)

- Rel. or Konfession or Rel: Your religion

- Steuerfr. Bezug (Steuerfreibezug) or Freibetrag or: Your tax-free allowance

- St. Tg. (Steuertage) – Tax days (usually 30 days for a full month)

- SV-Nummer (Sozialversicherungsnummer) or RV-Nummer (Rentenversicherungsnummer) – Social security number

- Krankenkasse: Your health insurance

- KK %: The contribution rate of your health insurance

- Eintritt or Eintrittsdatum: The date when you got hired

- SV-Tg. (Sozialversicherungstage): Social security days (also around 30 days)

- r SV Schlüssel orBGRS / Beitr.gr. (KV/RV/AV/PV): Social security contribution level and social security code (1 means full contribution)

- Lohnsteueridentifikationsnummer (Id Nr.) or Steuer-ID: Your Tax ID number

- Url. Anspr. (Urlaubsanspruch): Your vacation days according to your contract (between 20 to 30 are common)

- Url. Tg. gen. (Urlaubstage genehmigt): Approved vacation days year to date

Source: Simple Germany

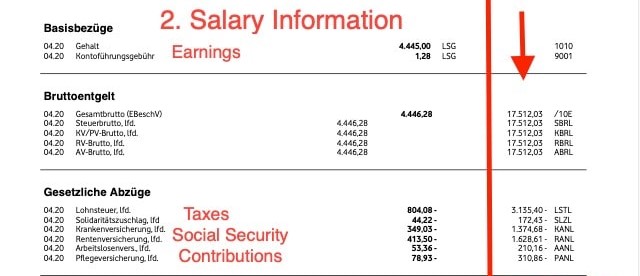

The Middle of The Payslip: Salary Information and More

This is the “meat” of the German payslip, where you can find information about your gross salary, social security contributions, and tax deductions. Here are the most important items in this area of the document:

- Your Taxable Payments: This is a list that specifies the payment sources, including your salary, bonuses, or holiday payments.

- Paid Taxes and Social Contributions: This part includes the taxes and social contributions you have paid and these are the variables that determine your net wage the most. Here are some of the most important payments that usually get deducted:

- Lohnsteuer (Wage Tax): Every employee pays income tax and is usually calculated and deducted from your salary by your employer. The amount you pay depends on the sum of money you earn and your tax class.

- Solidarity Tax: The costs originally went for the reconstruction of Eastern Germany, now, it’s paid only by the top 10% earners in the country.

- Kirchensteuer (Church Tax): The tax you pay if you are a member of a church

- KV or Krankenversicherung (HI/Health Insurance): As an employee in Germany, you have three health insurance options, depending on income. It can be either the public health insurance system, private insurance, or the company of the two. Typically, you pay 14.6% of your salary.

- RV or Rentenversicherung (PI/Pension Insurance): this insurance mostly depends on the amount of contributions you’ve made while employed. Approximately, 18.6% of your salary goes here.

- AV/Arbeitslosenversicherung (UI/Unemployment Insurance): After paying this for at least 12 months to 24, you become entitled to German-state unemployment benefits, which is around 60% of your previous net income. This deduction sits at 2.5% of your salary.

- PV/Pflegeversicherung (CI/Care Insurance): Similarly to health insurance, this insurance covers the costs of long-term home and residential care.

If understanding the german payslip (at least this part), proves more difficult, here’s a detailed breakdown:

- Brutto Bezüge: Gross earnings

- Bezeichnung: Salary description

- Gehalt: Your base salary per month

- Geldw. Vorteil or Sachbezug: These are the social contributions, subject to tax and non-cash benefits.

- VL AG (Vermögenswirksame Leistungen Arbeitgeberanteil): Your voluntary employer contribution to a savings plan

- Betr. BAV or AB (Betriebliche Altersvorsorge): Employer contribution to savings plan

- Einmalbezug or Einmalzahlung: One time bonuses like special achievements, allowances, and more.

- Urlaubsgeld: Holiday pay

- Gehaltsumwandlung: Tax or social benefit deductions

- ST-frei (Steuerfreie Bezüge): Your tax-free benefits

- Gesamtbrutto or Steuer-Brutto: The taxable amount of your salary or total gross salary

- Nettoverdienst or Auszahlungsbetrag: The net salary your employer pays to your bank account

- Lohnsteur (LSt.): Income tax

- Kirchensteuer (KiSt): Church tax

- Solidaritätszuschlag: Solidarity surcharge

- Steuerrechtliche Abzüge: The sum of all tax reductions

- KV-Beitrag (Krankenversicherung): Health insurance

- PV-Beitrag (Pflegeversicherung): Long-term care insurance

- Rentenversicherung (RV-Beitrag): Pension

- AV-Beitrag (Arbeitslosenversicherung): Unemployment insurance contribution

- Zusatzbeitrag: Other additional contributions

- SV-rechtliche Abzüge: The sum of all social security reductions

- SV-AG-Anteil (Sozialversicherung Arbeitgeber Anteil): The sum of all reductions that your employer pays

Source: Simple Germany

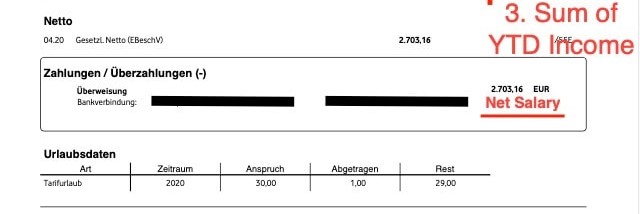

The Bottom of the Payslip: Understand the Rest of the German Payslip

Lastly, in the lower part of the document, you can see your final salary and the bank account number where you can pick it up. There’s also an overview of your total salary, contributions, and taxes, along with your taxation and contribution exceptions.

- Non-taxable Contributions: Your care and health insurance may appear among your paid contributions or here, among non-taxables, depending on how much you earn and whether your payment is taxable or non-taxable. If you have private health insurance, then it will appear here.

Source: Simple Germany

How To Read a German Payslip: Special Sections and Documents

The payslip in Germany may also contain special information that may require more explanation. These items also aim to help you with your budgeting and money management.

Urlaubstage

Your vacation days or leave entitlement allows you to see how many off days you have, indicating the days you have granted per contract, along with the days you used, and your remaining off days. If nothing else, it helps you plan your holidays without having to bother HR with it.

Reisekosten

If your job involves travel, this part of the document will contain all reimbursements for associated work expenses, such as transport and accommodation costs, along with others.The aim of this section is to keep your job-related expenses transparently and appropriately reimbursed.

Sachbezüge

This details non-cash perks that your employer offers. This can be anything from subsidized meals to company cars and health insurance premiums. Each of these items are given a monetary value that the state adds to your total earnings, which affects your net pay and taxable income.

Annual German Payslip

This special document is issued once every year and summarises your salary information, and also highlights all the social security contributions and wage taxes you paid. Typically, you will receive this from your employer at the end of February the next year. The tax office also receives a copy of this document.

One last thing: you should keep your payslips, as they are proof of the number of years you’ve been employed and the amount of taxes and contributions you’ve paid, especially for retirement. And even if you are not planning to stay in the country until then, payslips are also essential for filing your tax returns. Lastly, your employer has to keep these documents for at least six years, meaning you can request the ones you are missing from your previous employers.

The German Payslip: Decode Like an Expert

Once you fully understand the payslip, you also have better control over your finances. It’s the key component of money and tax management and feeling financially adept in the country. This transparent document showcases your earnings, deductions, and prevents any discrepancies in your payments.

If you ever encounter problems with your payslip or need further clarification, never hesitate to ask your company’s HR team. And if you are still looking for work in Germany, take a look at the currently open vacancies to get closer to your upcoming adventure in one of Europe’s strongest and most stable countries.

English

English  Lietuvių

Lietuvių  Latviešu

Latviešu  Polski

Polski  Português

Português  Română

Română  Slovenčina

Slovenčina  Magyar

Magyar  Русский

Русский  Espanol

Espanol  България

България  Čeština

Čeština  Italy

Italy  Croatia

Croatia  Greek

Greek