A payslip, in the Netherlands called a “loonstrook”, is an official document your Dutch employer gives you that details your salary. It’s important because it shows a breakdown of your pay and includes gross salary, deductions (income tax and social security), and net salary (what you actually receive in your bank account).

While Dutch payslips are essential for financial transparency, it can be challenging to decipher them. Filled with technical terms, abbreviations, and Dutch vocabulary, they can appear daunting even for native speakers.

However, we have your back. The purpose of this guide is to equip you with the knowledge to navigate your Dutch payslip with confidence and ease.

Understanding Your Dutch Payslip

While the layout of payslip may vary slightly between employers, Dutch payslips in general all follow a similar structure. This consistency ensures you’ll find the key information in the same place on each payslip, regardless of your employer.

This standardised approach makes understanding your gross and net salary breakdown and deductions much easier.

When and Why Do You Receive a Payslip?

In the Netherlands, when an employee receives their first salary for a new job position or if wages or taxes change, the employer is legally obligated to provide a payslip. While some employers might issue them less frequently, most will deliver your sample payslip at the end of each month.

However, some employers handle compensation on a weekly basis. If this is your case, don’t get confused since you probably won’t receive a payslip each week.

While the format can vary (you might receive it via email, through an internal company system, or on paper), the payslip must be transparent, and everything on it must be clearly specified for the employee.

Terminology and Abbreviations You Need to Know

Understanding a Dutch payslip can be problematic due to the abundance of social security abbreviations.

To simplify things, let’s begin by explaining the mandatory terms of social insurance, which are frequently listed on Dutch payslips. This will provide a strong foundation for navigating the rest of your payslip.

Here are some of the most important abbreviations you need to know:

- ZWV – Health Insurance Act

- WW – Unemployment Insurance Act

- WIA – Incapacity for Work Act

- ZW – Sickness Act

- ANW – Surviving Dependents Act

- AOW – General Old Age Pensions Act

- ZW – Sickness Benefits Act

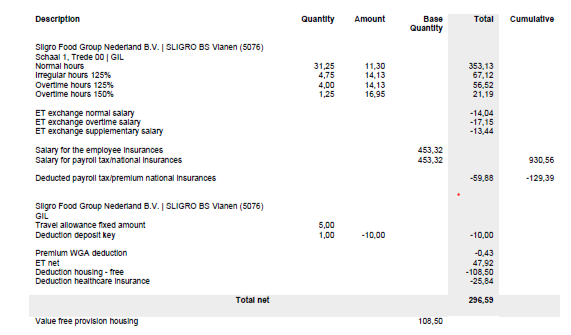

To make things even simpler, let’s break down your Dutch payslip into three manageable sections: the top, middle, and bottom sections. We’ll walk you through the information found in each part.

The Top Section: Personal, Date, and Employment Details

The very top section of your Dutch payslip acts as a quick reference for key details about the particular employee. This typically includes the full name and contact information on the left side and the employer’s name and contact information on the right side.

Following this, you’ll find a more in-depth breakdown of your employment status, including your date of birth, job title, and start date. Moreover, this section of the payslip also contains the following information:

- Pers. Nr (Personeelsnummer/Resourcenummer )- The employee identification number you’ve been given by the company.

- BSN (Burger Service Nummer) – The BSN number is the Citizen Service Number or personnel number of the employee under which you are registered with government organisations like the Dutch Tax Administration.

- Burg. Staat – Marital Status

- Parttime % – The number of hours worked (or the percentage) by the employee per week based on the full-time schedule. It is calculated when the working hours are divided by the number of hours per week that applies to the employer or to the applicable Collective Labour Agreement.

- Uurloon – This is the hourly salary. Divide the gross salary by the number of hours worked during that particular time period.

- Minimumloon – The legal minimum wage determined by the government.

- Kleur/Tabel – This part contains information about payroll taxes. It is differentiated in two different colours according to which tax table the payment is calculated. For example, ‘Wit’ means white, and it applies to wages for current employment, while the green part is for former employment/pension contributions.

- LH/LHKorting (Loonheffings Karting – Payroll Tax Credit) – Payroll tax credit is always taken into account when calculating the income tax. This is the wage tax/ social security contribution that the employee pays.

- ZWV/WW/WIA – Here you can see if you are insured under social insurance laws. ZWV = Health Insurance Act, WW = Unemployment Insurance Act, WIA = Incapacity for Work Act, and ZW = Sickness Act.

- Jaarloon BT – This is the gross annual salary for the previous year.

- Tarief BT (Rate percentage) – With the rating percentage, the payroll tax is calculated on special remuneration. For instance one-time payment like holiday allowance, 13th salary, or a bonus. The rating percentage can include the settlement percentage withholding tax credit.

- Dagen tijdvak – The period for which the salary is calculated (month, day, week, or quarter)

- Dagen gewerkt – Total number of days the employee worked for this period

- Verloonde uren – Total number of hours the employee gets paid for

- Auto v/d zaak – If you own company car

- Cat. Waarde – The category value of the company car

The Middle Section: Salary Calculations

The middle section of the payslip is where you’ll find information about your gross and net salary and how it is calculated. Make sure you pay attention to these two key columns:

Inhouding (withholding) – Here you’ll find in detail which portions of your salary are subject to the payroll tax rate.

SVW (employer contributions) – On the other hand, this section clarifies mandatory employer’s social security contributions made on your behalf. These contributions fund various social programmes, including:

- WW (Werkloosheidswet) – Unemployment benefits

- WAO (Wet werk en arbeidsongeschiktheid) – Disability benefits

- ZW (Ziektewet) – Sickness benefits

- Wlz (Wet langdurige zorg) – Long-term care benefits

Understanding these deductions will give you a clear picture of your after-tax income. Here you’ll also find the following terms:

- Bruto – This is the employee’s gross salary that includes expenses such as tax addition for a company car, holiday pay, and the withholding of social security premiums. These include taxes for pension purposes (pension premium, premium for retirement, and partner’s pension). All of these are deducted from the gross salary.

- Werknemer Verzekering (Employee insurance) – By law, all employers are obligated to pay social contributions on the wages of their employees. These premiums protect you as an employee against the financial consequences of unemployment or incapacity to work.

- Loonheffing (payroll tax credit or wage tax) – The discount on income tax and national insurance contributions. If you have multiple jobs, you can only get this tax credit discount at the job position with the highest salary.

- Declaratie onkosten – Here you’ll find information about the variable costs, such as declaration expenses (fuel, dinners while away, or the cost of using your phone for work purposes).

- Totalen – The total net salary.

- Betalen – Information on the Dutch bank account you provided where the net salary is deposited. Only IBAN is accepted.

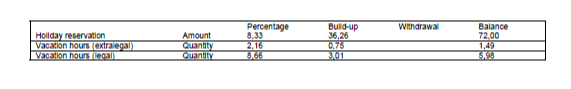

The Bottom Section: Long-Term Calculations

The bottom section of a Dutch payslip showcases the year-end calculations and totals. These can be:

- Reservering – This section covers different types of leave and allowances (13th salary, holiday allowance, different bonuses, etc.)

- Vakantiegeld – This is the cumulation of the holiday allowance that is saved in advance and will be paid out in May or June. The holiday pay is stated in euros.

- Fiscaal loon – The statutory minimum wage stated on which payroll taxes are calculated. The gross salary and Health Insurance Act form the taxable salary. Remember, wage tax and national insurance contributions are paid on this amount.

- SV/ZVW/WW/WAO Loon – These amounts are the wages on which employees pay income tax and social insurance contributions.

- Arbeidskorting (employed person’s tax credit) – Employees get a discount on payroll taxes, which is called a payroll tax credit. One of these is the employed person’s tax credit.

Keep in mind that the specific abbreviations and earnings breakdowns might vary slightly between payslips. However, once you overcome the basic terms, understanding your individual deductions becomes much easier.

Tips for Reading Your Dutch Payslip

The Dutch payslip can appear complex. It is filled with unfamiliar terms and numbers, however, there are some tips to help you navigate its intricacies and gain a clear picture of your salary and deductions:

- Recognise the Structure – Almost all Dutch payslips follow a standardised format. Even though the layout might vary slightly between companies, you’ll find the same elements in roughly the same place on every sample payslip.

- Start with the Basics – The top section usually presents information considering your employment contract, such as your and your employer’s full names and contact details. Following this, you’ll find your date of birth, job title, and start date.

- Right in the Middle – The central section will inform you about your net salary. Make sure you pay attention to two key columns – Inhouding (taxes withheld from your salary) and SVW (employee insurance contributions).

- Unravelling the Bottom – The bottom section deals with year-end calculations and the total annual income statement. Here you should look for pre-tax deductions, holiday allowances (in most cases this allowance is paid out annually in a lump, yet employers can divide it into smaller instalments and pay it out with the base salary payments), employer-paid national insurance contributions (unemployment, health insurance, disability, etc.) and a potential tax rate that reduces your overall tax burden.

- Consult Online Resources – Many employers offer online resources or explanation guides alongside your payslip. Use these tools to understand specific terms or abbreviations. If you’re still unsure about understanding your payslip, don’t hesitate to reach out to the HR department for clarification.

Why Is It Important to Read Your Dutch Payslip?

There are many reasons why it’s important to learn how to read your Dutch payslip:

- Ensures Accuracy – It allows you to gain insight and rest assured that you’re being paid the correct amount according to your employment contract. You can check your basic salary, allowances, taxes withheld, and net salary to ensure everything is as you expected.

- Provides Transparency – It also provides a clear breakdown of your income and deductions. By knowing how your salary is calculated, you can manage your finances more effectively.

- Helps with Taxes and Applications – A payslip in the Netherlands serves as official documentation of your income, which you need for tax filings, applying for benefits, or securing loans or mortgages.

- Identifies Errors – By reviewing your payslip, you can catch any mistakes in your salary and promptly notify your Dutch employer for correction.

- Empowers Financial Planning – Understanding your net pay allows you to plan your budget and living expenses effectively. You can allocate funds for savings, bills, and other expenses with ease.

Should You Keep Your Payslip?

You should definitely keep your payslips for a significant amount of time. There are a few valid reasons for this:

- Legal Requirements – Tax authorities might request them for tax audits up to 6 years after the relevant tax year so make sure you store them safely. This can be helpful in the event of any future disputes regarding your salary or benefits.

- Benefits and Pensions – Your payslips can be crucial for proving your income history when applying for social benefits or calculating your pension contributions. It’s recommended to keep all payslips that show these contributions since they might not be available anywhere else.

- Financial Security – Payslip is a proof of your income. You might need it when applying for loans, mortgages, or renting a property. Having a record of your income demonstrates financial stability.

Become a Dutch Payslip Pro in No Time

Conquer your payslip, and you’ll conquer your finances! Understanding your Dutch loonstrook is the key to budgeting, managing taxes, and feeling financially secure in the Netherlands. This knowledge empowers you in several ways.

It ensures you’re being paid accurately, provides transparency into your income and deductions, and prevents any financial discrepancies.

Remember, clear communication is key. If you have any questions or require further clarification about a specific aspect of your payslip, don’t hesitate to reach out to your HR department.

And if you’re still looking for a job in the Netherlands, explore the open vacancies and get ready to start your work abroad experience in the country with one of the highest average and minimum wages.

English

English  Lietuvių

Lietuvių  Latviešu

Latviešu  Polski

Polski  Português

Português  Română

Română  Slovenčina

Slovenčina  Magyar

Magyar  Русский

Русский  Espanol

Espanol  България

България  Čeština

Čeština  Italy

Italy  Croatia

Croatia  Greek

Greek