Did you know that the Netherlands is the eighth-highest-paying country in the world?

With its central European location, it’s a thriving economic centre and one of the top European working destinations. People from all around the world choose this country in search of great career opportunities.

The Netherlands is a leader in various industries (healthcare, information technologies, production, technical, logistics, and agriculture), providing diverse job opportunities. With that in mind, understandably, the average salary in the Netherlands is higher; however, these ranges fluctuate significantly for every profession.

This article explores the current average salary in the Netherlands in 2026. Examining average wages and tax brackets will shed light on the Dutch financial landscape, empowering you to make informed career and financial decisions.

Key Takeaways

- The Netherlands is the eighth highest-paying country globally and has the highest minimum wage compared to other European countries.

- The average gross salary in the Netherlands is €44,000 per year, or around €3,666 per month. However, keep in mind that some individuals will earn minimum wage for the same position according to their education and experience. The minimum wage for employees aged 21 and older, for 40 working hours is around €1,725 gross.

- Be aware of the difference between the gross and net income amounts. After all the tax deductions are subtracted, an average monthly net salary is around €2,600 per month, or €35,093 per year.

What’s the Average Salary in the Netherlands?

Typically, the average gross salary is around €3,666 monthly, or €44,000 as an average annual salary, according to the Dutch Central Planning Bureau. However, after taxes, social security contributions, and other deductions, the average monthly net salary is closer to €2,600, or €35,093 for an average yearly salary.

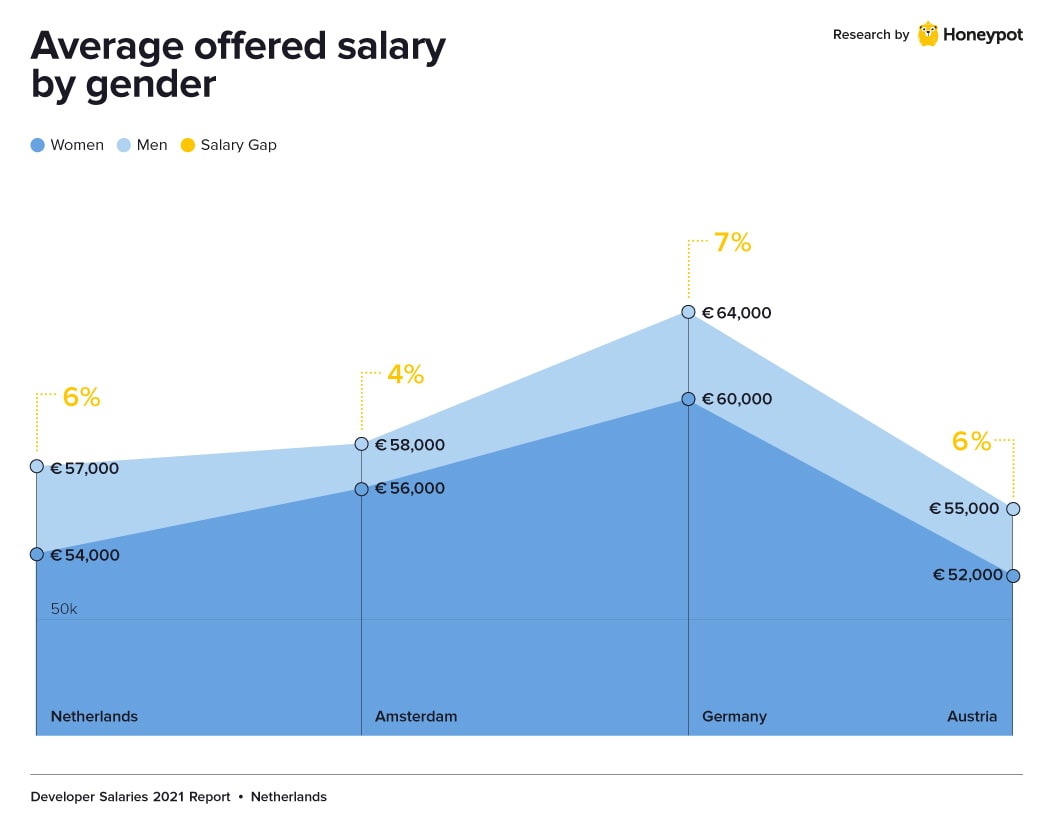

Some individuals may receive significantly higher compensation for the same position as you due to their professional experience. On the other hand, some might earn lower wages (considerably below average salaries) due to factors such as age, lower educational levels, gender pay gap, lack of experience, or company size.

However, the average Dutch employee is still ranked among the higher-earning European workers.

Average Salaries in the Netherlands by Profession

With its dynamic economy, the Netherlands offers plenty of high-paying jobs. These opportunities are available in sectors that require specialised skills, advanced degrees, and extensive experience. As a result, the average wage in the Netherlands varies significantly across different professions.

|

Profession |

Average Salary (Gross) |

|

Factory Worker |

€2,705 |

|

Assembly Line Worker |

€3,697 |

|

Pickers in the Food Industry |

€3,015 |

| CNC Operator |

€3,770 |

| Welder |

€4,312 |

|

Carpenter |

€1,980 |

| Construction Worker |

€4,023 |

|

Civil Engineer |

€4,660 |

| Construction Project Manager |

€7,710 |

|

Plumber |

€4,744 |

| Electrician |

€5,061 |

|

Mechanical Engineer |

€4,590 |

| Nurse |

€3,920 |

|

Laboratory Technician |

€3,670 |

| Receptionist |

€1,990 |

|

Cashier |

€1,980 |

| Waiter |

€1,680 |

|

Cook |

€1,948 |

| Cleaner |

€2,334 |

|

Office Administrator |

€2,373 |

| Truck Driver |

€2,550 |

|

Reach Truck Driver |

€2,084 |

| Car Mechanic |

€2,932 |

Average Salary in the Netherlands by City

As of 2026, Eindhoven has the highest average income in the Netherlands, followed by Amsterdam. This is partly due to their roles as key economic hubs and centres for startups. These cities thrive in various industries, including finance, technology, creative arts, and tourism, all of which contribute significantly to their economic strength.

|

City |

Average Salary (Gross) |

| Eindhoven |

€5,580 |

| Hague | €4,712 |

| Amsterdam | €4,672 |

| Rotterdam | €4,409 |

| Utrecht | €4,318 |

| Bussum | €4,206 |

| Leiden | €3,916 |

| Breda | €3,705 |

| Coevorden | €3,694 |

| Almere | €3,583 |

| Groningen | €3,583 |

| Tilburg | €3,250 |

What’s the Net Salary After Tax in the Netherlands?

If you are living in a well-organised country such as the Netherlands, you’ll be obligated to pay a wide variety of taxes. Naturally, with higher salaries, a higher income tax comes as well. When it comes to income tax, as a Dutch resident, you will be taxed at 37.07% or 49.50%.

The exact amount depends on your annual salary. Residents that make more than €75,518 annually will pay a higher income tax rate.

What is Incorporated Into Your Dutch Salary?

Dutch salaries include an abundance of benefits. Let’s start with the most important benefit: sick leave.

In the Netherlands, the Dutch Government implemented a law that obliges your employer to pay you 70% of your wages while you are on sick leave. If you are sick for a longer period, there is no risk of losing your position. By law, your employer must pay your sick leave for up to 104 weeks during your employment contract.

Some companies offer a 13th-month salary. You will receive one extra salary before the holiday period in November or December. In most cases, that bonus equals around 8% of your salary.

Besides the 13-month salary, many employers offer a holiday allowance (vakantiegeld) in the amount of at least 8% of your annual earnings, which is close to your average monthly salary. This allowance is paid in May or June.

When you are recruited from abroad, there is a great chance that you will receive remuneration packages, including coverage for initial housing and moving costs, while some Dutch employers go further and even offer financial support for international schools for your children.

The Netherlands is famous for its 30% rule for expats. This rule gives you the possibility of getting 30% less income tax on your salary for the first 20 months, resulting in a higher net income.

Dutch Payslip Explained

As a Dutch employee, with each month’s salary, you’ll receive a payslip (loonstrook) from your employer. This document includes information about your salary, how your wage was calculated, and the amount that has been subtracted. It can be very hard to understand a Dutch payslip as a foreigner, so here is a basic breakdown:

- Periode – the exact time frame of your salary (month or week)

- Personeelsnummer – your number

- Salaris / uurloon / periode / maand / year – the gross salary pre-tax (per hour /month /period /year)

- Bijz. tarief / heffingskorting (ja) – the special tax rate for bonuses and general tax credit (indicated by yes)

- Verzekerd voor WW, WiA, ZW, Zvw – contribute to the social security you are covered for

- Datum in dienst – the date you signed your employment contract

- Burgerservicenummer (BSN) – your Dutch social security number

- Functieomschrijving – your job description or job title

- Normale gewerkt uren – the number of your working hours

- Brutoloon, Belastbaar loon / Loon / Loon voor de loonheffing – taxable wage or gross salary

- Pensioengevend loon – salary for pension purposes

- Loonheffing – the amount that was deducted as prepaid tax and social security contributions

- Sociale verzekeringen (SV) – social security contributions

- Reiskostenvergoeding – transport compensation

- Nettoloon – the net salary after tax, deductions, and refunds; this is the amount you’ll receive in your bank account.

- Cumulatief – cumulated salary over the year

- Opgebouwd vakantiegeld – the (accumulated) holiday allowance or leave in hours

What’s the Minimum Wage in the Netherlands?

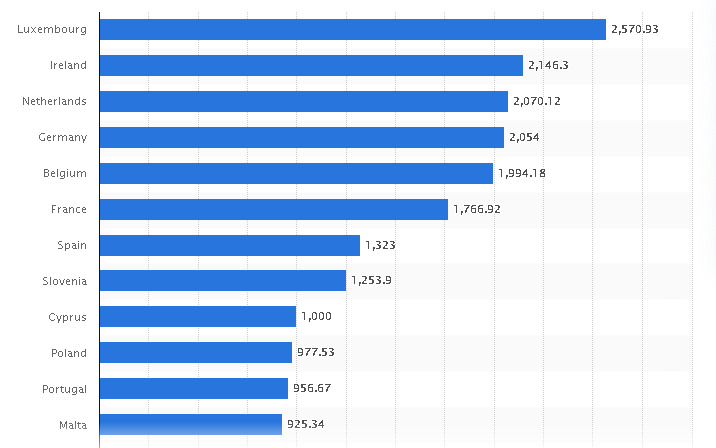

The minimal wage is a legally mandated minimum amount that an employee must be paid. Twice a year, the Dutch government updates the minimum wage on January 1st and July 1st. This adjustment reflects fluctuations in basic salary as well as living costs. You should note that the Netherlands has the highest minimum wage compared to other European countries.

For workers aged 21 and over, the minimum monthly wage for a standard full-time position (40 hours a week) is around €1,725 gross per month. In some sectors, due to collective labour agreements, a standard workweek is set for 36 or 38 hours. This means that the minimum wage is higher in these sectors.

The minimum hourly wage is different in specific industries. However, the standard minimum hourly wage is around €13.27 for employees aged 21 and over. When it comes to younger workers under the age of 21, the minimum youth wage applies. They receive lower salaries compared to adults. Their wages increase gradually until they reach the age of 21.

|

Age |

Per Hour | Per Month |

|

15 years |

€3.98 | €689.81 |

| 16 years | €4.58 | €793.81 |

|

17 years |

€5.24 | €908.20 |

| 18 years | €6.64 | €1.150.84 |

|

19 years |

€7.96 | €1.397.63 |

| 20 years | €10.62 | €1.840.66 |

| 21 years and over | €13.27 | €2.299.96 |

Average vs. Median Salary – what’s more relevant?

Understanding income distribution involves two key measures: average and median. The average salary, also known as the mean, simply adds up everyone’s income and divides that amount by the total number of people. It’s easy to calculate, but high earners can mix things up and paint a picture that is not real.

The median income in the Netherlands, on the other hand, provides a more representative picture. By arranging incomes from lowest to highest and finding the middle value, the median is less affected by extreme cases. As a result, the median income is typically lower than the average.

The median salary in the Netherlands varies in the different sectors and is considered more relevant than the average salary, particularly in industries prone to a significant gap between the salaries of senior executives and the standard worker.

Calculating Your Dutch Salary: Understanding the Difference Between the Gross and Net Income

Whether you earn a monthly salary or are paid hourly wages, you’ll notice phrases like gross and net salary on your paycheck. It is crucial to know the differences between bruto and neto income to be able to create an accurate monthly or yearly budget and make sound financial decisions.

Gross salary (bruto) is the total amount you’ll receive before any taxes and deductions are accounted for. This is the highest number you will see on your pay statement and it is based on your previously agreed salary or hourly wage.

Net salary is the amount of money that you’ll receive in your bank account once all the taxes and deductions have been subtracted from your gross salary. You will easily recognise the Dutch net salary amount on your paycheck statement since it appears in a larger, bolder font than your gross salary.

Let’s break down a sample scenario. Earning €20 per hour for a 30-hour workweek means your weekly gross salary is €600, or €31,200 annually. Taxes will reduce this significantly. Assuming a 37.1% tax rate, your net income will be around €26,046 per year. Remember, this is before factoring in work-related expenses like commuting.

It’s very important to discuss your net salary in the Netherlands with your potential employer so you’ll be certain of how much actual money you will receive for your services.

Compensation Costs for Employees

The costs of compensating employees in the Netherlands go way beyond the gross salaries and include a wide variety of elements that form an employee’s remuneration package.

It is crucial for businesses operating in the Dutch job market to understand these costs, as they greatly impact overall financial planning. The exact figures for these costs vary based on industry, age, position, experience, and collective labour agreements. Regardless, the average cost on top of the gross salary ranges between 20% and 35%.

These elements are included in the employee remuneration package:

- Direct wages – This is your gross wage, which includes all bonuses or allowances that are regularly paid out.

- Social Security contributions – Employers are required to pay these contributions to fund a variety of benefits for you, such as health insurance, unemployment insurance, and pensions.

- Insurance contributions – Specific industries and job positions require specific insurance contributions, like liability or accident insurance.

- Pension contributions – Some employers offer you the option of private pension schemes besides the basic state pension (AOW).

- Payroll taxes – These payroll taxes help finance public services and social security funds.

- Leave entitlements – This considers all the paid leave entitlements, such as sick leave, maternity/paternity leave, and vacation. They are part of the statutory leave benefits in the Netherlands.

- Other labour costs – These costs usually include expenses related to training, workshops, and investing in employee’s professional development. This also includes employee benefits like a company car, mobile phone, gym membership, childcare support, and meal vouchers.

To you, as a potential hire, these comprehensive remuneration packages can tell a lot about the company’s care for its employees. The more diverse the compensation package, the more attractive and reliable the company is.

Which Factors Impact the Average Salary in the Netherlands?

A variety of factors influence salaries in the Netherlands. These factors will define how much you can earn. Here is a list of the main factors that influence the average salary:

- Educational level – People with higher education qualifications (bachelor’s, master’s, or doctoral degrees) usually earn higher wages due to the knowledge and skills they provide.

- Professional experience – Individuals with several years of relevant experience have a higher chance of getting hired and earning significantly above the average income. This is because they add more value to the company with their knowledge and practical skills in the specific industry.

- Industry – The average wage in the Netherlands varies significantly depending on the industry. Some sectors, such as engineering, medicine, information technology, or finance, offer higher wages. On the other hand, hospitality and retail offer lower wages due to economic trends.

- Company size – Larger corporations are capable of offering higher salaries in comparison with startups and smaller companies.

- Location – Your location in the Netherlands plays a prominent role in your Dutch salary. In urban areas like Amsterdam, many different international companies operate and offer higher average salaries compared to smaller cities and rural areas.

- Contractual arrangements – The type of contract (permanent, temporary, freelance) generally affects earnings. Permanent contracts are more stable and offer higher wages than temporary or freelance contracts.

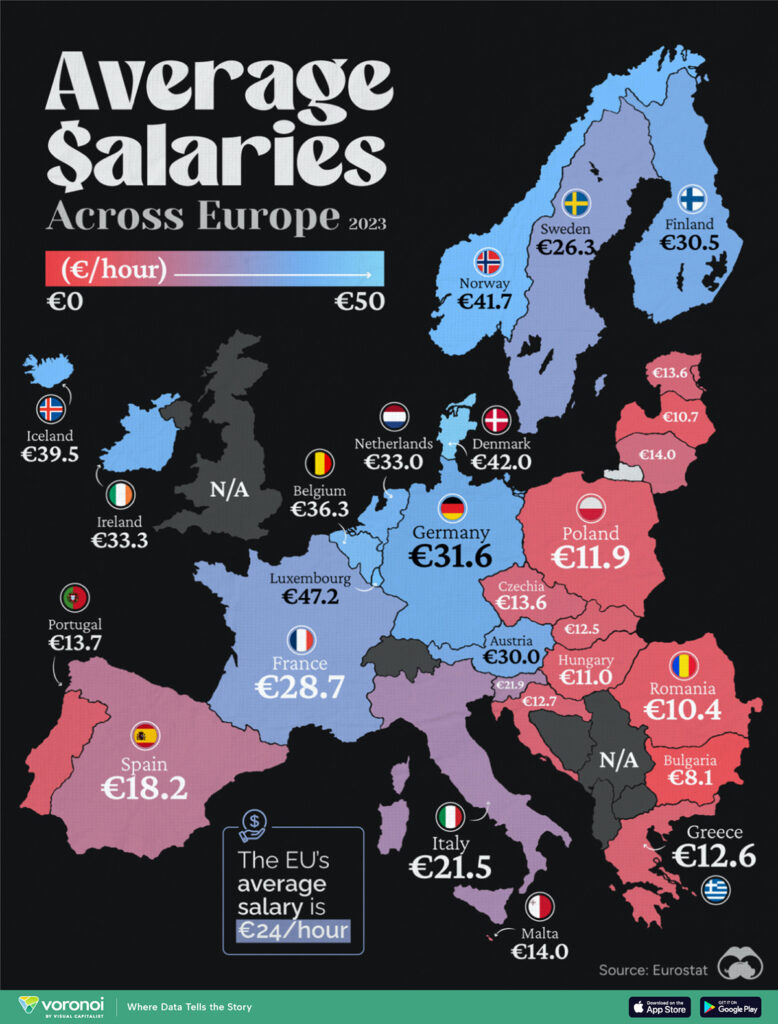

Comparison With Other European Countries

Overall, the Netherlands ranks pretty high when it comes to average salary and minimum wage compared to many European countries. The country’s stable and prosperous economic standing is the main reason why many foreign workers and expats choose to move there.

|

Country |

Average Salary (gross) |

|

Netherlands |

€3,666 |

|

Switzerland |

€6,880 |

|

Denmark |

€5,400 |

| Sweden |

€2,860 |

| Belgium |

€3,500 |

| Germany |

€3,830 |

| United Kingdom |

€3,100 |

|

France |

€3,530 |

| Spain |

€2,816 |

|

Portugal |

€1,463 |

The Netherlands holds a competitive position in terms of wages in the Western European region. While the average salary and minimum wage are higher than in Spain or France, they are lower compared to Switzerland, Luxembourg, or Norway standards.

On the other hand, compared to the Eastern Europe region, salary and minimum wage are significantly higher due to the different economic standings.

Beyond the gross salary, the Netherlands offers a comprehensive welfare state with extensive social services, providing additional value to Dutch residents.

Moving to the Netherlands Shouldn’t Be Just For the Salary

Choosing a new country can make or break your professional journey. Luckily, the Netherlands could be a perfect fit for you since it has progressive policies, a booming economy, and an amazing quality of life.

This is the main reason why it is a top choice for international professionals seeking both working opportunities and a fulfilling lifestyle. The Netherlands is a magnet for multinational corporations like Nike, Adidas, Tesla, and IKEA to Netflix.

These companies provide a minimum wage above average and an opportunity to experience work in different sectors like technology, finance, logistics, and the creative arts.

Many industries in the Netherlands operate 24/7, so you can earn more by working outside regular hours. This way, you become eligible for shift allowances, which can substantially increase your earnings.

For a foreign worker, a high level of English proficiency is a big plus since many companies conduct their business in English. Don’t forget the presence of a world-class educational and healthcare system that prioritises the education and well-being of all residents.

If professional development and an improved life standard are your ultimate goals, then there is only one thing to do – explore vacancies in the Netherlands and see what this country has to offer you.

Frequently Asked Questions About Salaries in the Netherlands

What Is a Good Salary In the Netherlands?

A gross work income between €2,500 and €3,600 per month is considered good in the Netherlands. Annually, this amounts to between €30,000 and €40,000. This translates to a net salary of between €2,159 and €2,613 per month after taxes. If you consider a monthly cost of living of around €2,044, this salary allows you to comfortably cover your basic expenses and still save some money.

How Will Inflation Impact Dutch Salaries in 2026?

While the cost of living surged by 14.5% in 2022, the government responded with a significant minimum wage increase of 10.15%. For 2026, the Central Planning Bureau forecasts an average net income rise of 5.6%. People earning the minimum wage will see the biggest boost, effectively receiving an extra four hours of pay per week.

What Is the average Salary in the Netherlands by Age?

The average salary for professionals in the age range of 25 to 45 is €37,900. On the other hand, the salary limit is higher for the older generation; individuals aged 45 to 65 earn an annual income of €42,700.

The Netherlands Enterprise Agency allows 15-year-olds to take on supervised light work after school and during holidays. However, this excludes them from operating machinery or factory work. They earn the minimum youth wage, which is currently €3.98 per hour, not per day.

English

English  Lietuvių

Lietuvių  Latviešu

Latviešu  Polski

Polski  Português

Português  Română

Română  Slovenčina

Slovenčina  Magyar

Magyar  Русский

Русский  Espanol

Espanol  България

България  Čeština

Čeština  Italy

Italy  Croatia

Croatia  Greek

Greek