The minimum wage is the lowest legal amount employers must pay their workers for their labour. In this article, we will provide all the details about the basic wage in Germany, including the German hourly minimum wage, the taxes and exceptions, differences in sectors and country regions, and the calculated daily wages in Germany.

The Current Minimum Wage

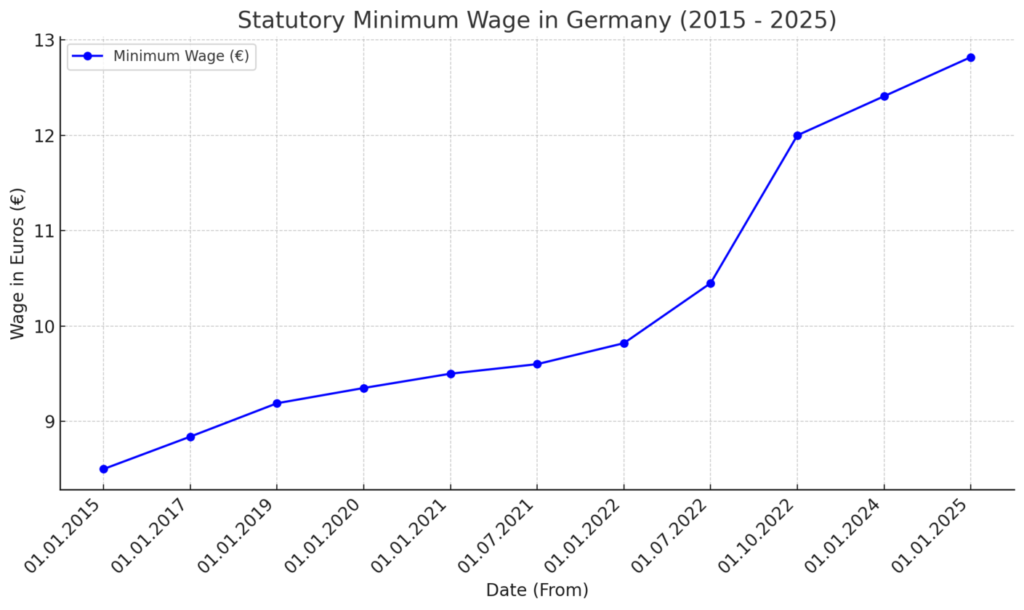

The minimum wage in Germany is €12.41 per hour, translating to €2,054 gross per month salary or €99.28 daily wage in Germany. This hourly rate serves as the legal minimum employers must pay eligible employees for each hour of work.

The 12.41 euros per hour is the gross wage, meaning it is the amount earned before tax deductions. It’s a baseline level of compensation across industries, ensuring that workers across the country receive this amount. This new rate became effective on January 1, 2026, marking a slight increase from the previous rate of €12 hourly wage in 2024.

For businesses, especially small enterprises, the adjustment requires careful financial planning to absorb the additional labour costs without reducing staff or hours.

Legal Framework: The Minimum Wage Act

The legal framework governing the minimum wage in Germany is established by the Minimum Wage Act (Mindestlohngesetz), which came into effect on January 1, 2015. This law introduced a nationwide statutory minimum wage, ensuring that the workforce receives fair compensation for their work regardless of industry. Additionally, the minimum wage law directs that employees are paid for overtime, with the minimum wage as the base salary.

Employers are legally obligated to comply with Germany’s minimum wage per hour, and violations can result in significant penalties. Some exceptions exist for apprentices, interns in vocational training programs, and individuals under 18.

The minimum wage in Germany is periodically reviewed and adjusted by the Minimum Wage Commission, with worker representation consisting of employers, employees, and independent experts.

The Role of the Minimum Wage Commission

The Mindestlohnkommission is responsible for reviewing and proposing changes to the minimum wage in Germany every two years. The commission considers economic growth, inflation, productivity, and overall labour market conditions. Their recommendations aim to strike a balance between protecting workers’ incomes and maintaining the competitiveness of businesses.

What Tax Deductions Are Applied?

The minimum wage in Germany is subject to income tax deductions. Workers earning the minimum wage must pay applicable taxes such as income tax, social insurance contributions, and solidarity surcharges.

These deductions reduce the take-home pay, though the minimum wage should provide a sufficient baseline before applying these taxes.

The breakdown of Germany’s minimum wage after tax:

- Income Tax:

The income tax rate in Germany is progressive, going up to 45% depending on annual income. As of the latest update, tax brackets are 0% for income up to €11,604; 14%-42% for income between €11,604 and €66,760; 42% for income between €66,760 and €277,825; and 45% for income above €277,825.

2. Social security contributions are mandatory for all employees and are shared between employers and the workforce:

- Health insurance tax is 14.6% of gross income. Depending on the specific insurance provider, there’s an additional supplemental charge typically around 1.3%.

- Pension insurance tax is 18.6% of gross income.

- Unemployment insurance tax equals 2.6% of gross income.

- Long-term care insurance tax is 4% of gross income, but there are deductions for employees with children.

3. A solidarity surcharge of 5.5% applies only to high-income earners.

The social security contributions ensure that workers have access to public health facilities, pensions, and unemployment insurance.

Enforcement and Penalties for Non-Compliance

Employers must maintain accurate records of working hours, especially for the workforce in any low-wage sector, such as hospitality or cleaning services. Failure to comply with these documentation requirements can result in penalties.

Consequences for Violating Germany Minimum Wage Laws

Non-compliance with minimum wage laws can result in significant consequences for employers. If found guilty of underpaying employees, employers can face:

- Fines of up to €500,000, depending on the severity and duration of the violation.

- Employers would be required to pay the difference between the payments and the minimum wage, along with potential interest.

- Companies that fail to comply with minimum salary laws can be excluded from bidding on public contracts for a set period.

How Employees Can Report Minimum Wages Violations

Employees who believe they are being underpaid or that their employer is violating minimum wage laws can report these issues to the Financial Control of Illegal Employment (Finanzkontrolle Schwarzarbeit – FKS). They can file complaints anonymously, ensuring protection from retaliation.

Workers can also seek legal action through labour courts to claim unpaid wages and hold employers accountable. Labour unions and workers’ rights organisations often provide additional support.

How Does Germany’s Wage Structure Look in 2026?

Germany implemented a range of statutory and branch-specific minimum wages across various industries. If any sector’s minimum wage falls below the general statutory minimum of 12.41 euros per hour, then the minimum wage becomes applicable.

For example, educational staff earn €18.58 per hour in 2024, increasing to €19.37 in 2026 and €20.24 in 2026, with higher rates for those with additional qualifications. The German Federal Statistical Office lists the minimum salary per industry.

Image Source: Statista

Wage Updates, Key Figures, and Trends

In this section, we will look at some of the most important data regarding worker compensation in Germany:

| Category | Details |

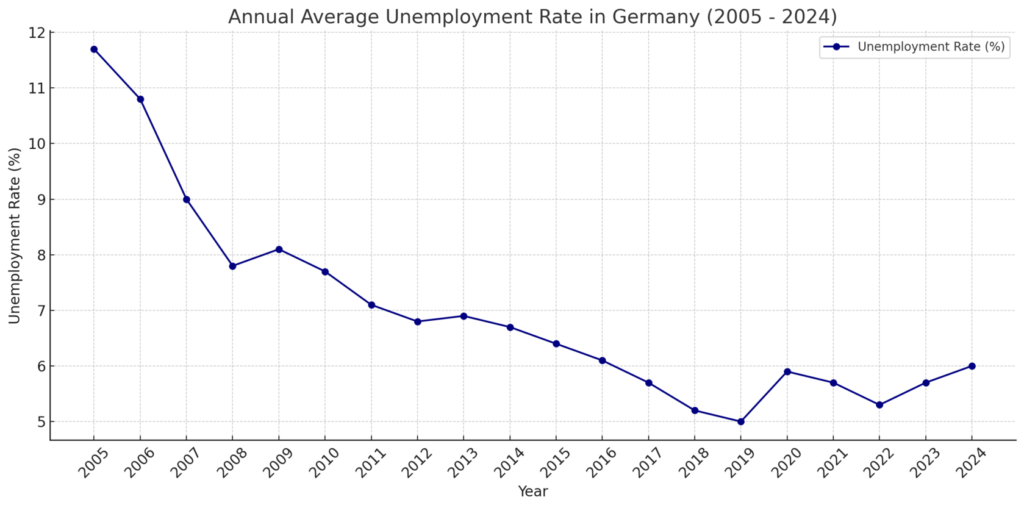

| Unemployment Rate | 3.5%—Among the lowest in the EU |

| Average Gross Monthly Earnings | Expected to reach €4,560 by the end of 2026 |

| Gender Pay Gap | 18%—One of the largest in the EU |

| Income Inequality | Top 10% earners: 23.5% of total income

Bottom 50% earners: 18% of total income |

| Wage Distribution | More than 15% of workers earn close to the German minimum wage level. |

| Sectoral Wage Differences | Finance & IT: €6,000+ monthly

Hospitality & Retail: €2,500–€3,000 monthly |

| Regional Salary Gap | Western Germany: ~€45,000 annually

Eastern Germany: ~€37,250 annually (17% lower than Western Germany) |

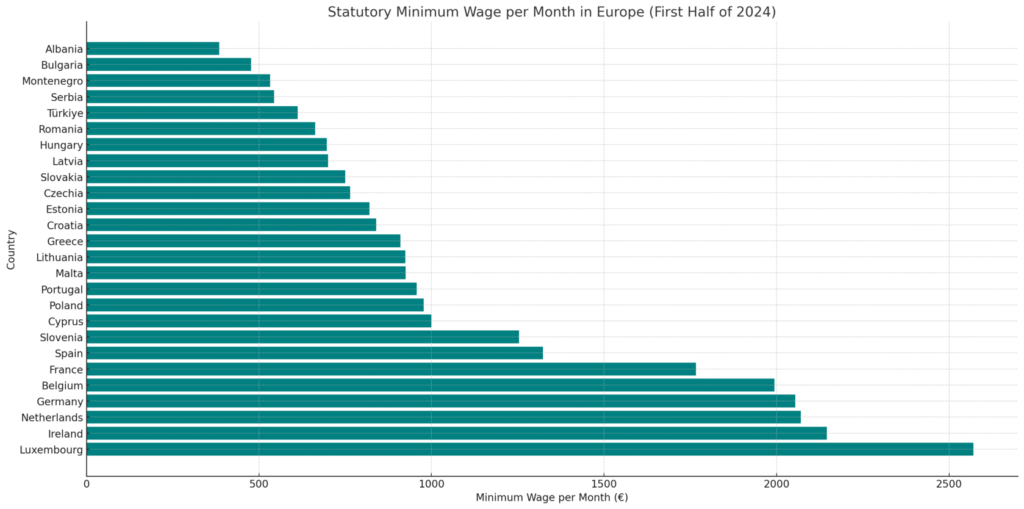

Image Source: Statista

The highest-paying regions include cities like Hamburg and Hesse, where salaries exceed the national average salary by around 10%. In contrast, a federal state like Thuringia reports some of the lowest wages, with average salaries around €2,400–2,500. These differences reflect historical economic disparities and varying levels of industrial development since reunification.

Image Source: Statista

Minimum Wage Increase in 2026

Looking ahead to 2026, the Commission for Minimum Wage will likely consider factors such as continued inflation, economic performance, and rising living costs when proposing adjustments. It is speculated that the minimum wage increase will put the minimum at €12.82 hour salary in Germany to ensure a living wage for all workers.

The exact minimum wage increase for 2026 will depend on evolving economic and social conditions, but a modest increase is expected to support worker purchasing power while maintaining business competitiveness.

What Are the Upcoming Labour Ministry Plans?

On September 9, 2024, German Labour Minister Hubertus Heil announced plans to raise the Germany basic salary to €15 to address the rising cost of living and comply with a European Union directive. Speaking on ARD, Heil emphasised the importance of ensuring a reliable wage that allows workers to sustain themselves.

While trade unions welcomed the proposal, it sparked dissent within Germany’s governing coalition. Heil noted that the increase would benefit six million people and projected that by 2026, the minimum German hourly salary would reach between €14 and €15.

How Wage Changes Affect You

In this article, we shared an in-depth look at the minimum wage in Germany. So far, you’ve learnt about the complexities of the German wage system and how these changes will affect you as an employee.

If you’re still looking for a job in Germany, now’s the perfect time to register on Robin and explore German job offers. Our recruiters will help you find a job with accommodation and competitive pay!

English

English  Lietuvių

Lietuvių  Latviešu

Latviešu  Polski

Polski  Português

Português  Română

Română  Slovenčina

Slovenčina  Magyar

Magyar  Русский

Русский  Espanol

Espanol  България

България  Čeština

Čeština  Italy

Italy  Croatia

Croatia  Greek

Greek